Content

He currently researches and teaches economic sociology and the social studies of finance at the Hebrew University in Jerusalem. NerdWallet strives to keep its information accurate and up to date. This information may be different than what you see when you visit a financial institution, service provider or specific product’s site. All financial products, shopping products and services are presented without warranty. When evaluating offers, please review the financial institution’s Terms and Conditions. If you find discrepancies with your credit score or information from your credit report, please contact TransUnion® directly.

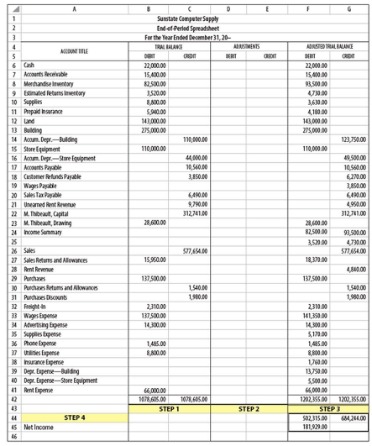

The total amount of the transactions in each case must balance out, ensuring that all dollars are accounted for. Debits are typically noted on the left side of the ledger, while credits are typically noted on the right side. The system might sound like double the work, but it paints a more complete picture of how money is moving through your business. And nowadays, accounting software manages a large portion of the process behind the scenes.

What Are the Different Types of Accounts?

A batch of postings may include a large number of debits and credits, but the total of the debits must always equal the total of credits. Liabilities in the balance sheet and income in the profit and loss account are both credits. So, if you buy something on credit, the amount is credited to the supplier’s account. It may help you to remember the rules if you keep in mind that assets in the balance sheet and costs in the profit and loss account are both debits. In this example, $5,000 is also credited to the bank account.

Credits are accounting entries that either increase a liability or equity account, or decrease an asset or expense account. A credit is on the right side when you record transactions. Debits are accounting entries that either increase an asset or expense account, or decrease a liability or equity account. Conversely, when a transaction decreases assets or expenses, the company records it on the credit side. The credit side recording also applies when the transaction increases the liability and equity account.

Double-Entry Accounting: Meaning, Examples

The most common type of single-entry system is a checkbook where income and expenses are added or deducted from a running cash balance. If you’re the owner of a small business and you wish to apply for a loan, you will need to show an accurate picture of the financial health of your business. Because double-entry accounting is the https://kelleysbookkeeping.com/ standard way to record finances in business, it’s important to understand the principles behind it. Liabilities Account → The liabilities that a company owes to a third party , e.g. accounts payable, accrued expenses, notes payable, debt. The debit and credit treatment would be reversed for any liability and equity accounts.

The transaction is recorded as a “debit entry” in one account, and a “credit entry” in a second account. The debit entry will be recorded on the debit side (left-hand side) of a general ledger account, and the credit entry will be recorded on the credit side (right-hand side) of a general ledger account. If the total of the entries on the debit side of one account is greater than the total on the credit Double Entry Accounting Defined And Explained side of the same nominal account, that account is said to have a debit balance. In accounting, credit, and debit refer to entries recorded in financial records. A credit entry represents money received or reduced liabilities, while a debit entry represents money paid out or an increase in assets. For instance, when a company receives payment from a customer on credit, it credits its accounts.